It’s an empirical fact that the economy experiences business cycles, in other words, oscillations between booms and busts. Furthermore, many argue that the economy is experiencing a secular decline. For example, productivity across all industries has decreased since the 1970s. What ares the mechanisms behind these instabilities and also decline? What would an accurate theory of economic crisis look like?

Source: https://www.brookings.edu/wp-content/uploads/2016/09/wp22_baily-montalbano_final4.pdf

Source: https://www.brookings.edu/wp-content/uploads/2016/09/wp22_baily-montalbano_final4.pdf

I believe that capitalism is both unstable and vulnerable to business cycles, and is also experiencing secular decline. The source of these trends are feedback mechanisms that are structural to capitalism that encourage the growth of fragile and expensive complexity (logistics, rent-seeking, finance, etc) due to the pursuit of short-term profits. Furthermore, this complexity becomes increasingly separated from the human labor (see Marx on labor theory of value) that creates wealth indirectly or directly (e.g. the factory worker, the doctor, the teacher, etc.), which means a larger ratio of overhead versus wealth creation. The growth of expensive complexity in the long run means both declining productivity and fragility to the business cycle.

I will first review some of the theories that already exist to explain this secular decline and also the nature of business cycles. Then I will present my own crisis theory that addresses the weaknesses of the other existing models.

The mainstream economic approach to the business cycle is modelled through the so called Dynamic Stochastic General Equilibrium model (DGSE). In this model, mainstream economists assume the world economy is more or less in equilibrium (e.g. markets clear, and agents’ utility functions maximize) until a random shock appears, for example, a sudden rise in oil prices. The nature and the source of the shock are irrelevant in this model – the DGSE approach only dictates that random shocks are an economic reality. Thus the task of the economist reduces to studying how the structures of the economy amplify/dampen and propagate the shock. For example, after the 2008 crash, economists began taking seriously how aspects of the financial sector may amplify these shocks (they call these financial frictions). It appears mainstream economists only have achieved a consensus on business cycle modelling but not necessarily on the secular decline of the economy.

Hyman Minsky was an important heterodox thinker that elaborated a crisis theory, and also recently became widely cited because of the 2008 crash. Minsky argued that crisis emerges from endogenous activities in the financial sector. Minsky explained that in booming times, banks and other financial institutions become “euphoric” and begin lending and also borrowing large quantities that in bust periods they would find too risky. Given that these financial actors are overconfident, a speculative investment bubble develops. At some point, the debtors cannot pay back, and the bubble bursts, creating a crisis.

The more orthodox of the Marxist approaches to crisis is referred famously as the theory of the tendency of the rate of profit to fall (TRPF). According to Marx, capitalism experiences a secular decline in the rate of profits as work is automated away by machines, and therefore less workers are employed, which means less human labor to exploit. As production becomes more optimized, machinery and raw material absorb more of the costs of production, and less workers are employed due to rising productivity. In marxist analysis, profit comes from exploitation of workers, that is, from paying workers less than the value created by the hours they worked. So in marxist analysis, as machinery automates more of the labor, the rate of profit also declines. According to Marx, in a hypothetical scenario where all labor becomes automated by robots, the capitalist wouldn’t profit at all!

Finally there are some crisis theories were more heterodox marxist models and pseudo-keynesian theories converge. Thomas Palley recently compared Foster’s Social Structure Accumulation theory (SSA) to his own theory, Structural Keynesianism. Both Palley and Foster argue the decline of economic growth is related to a stagnation of wages. If wages are stagnant, the aggregate demand necessary for growth is unmet, because workers don’t make enough to purchase commodities. They argue that this economic stagnation is related to the neoliberal growth model adopted since the 1970s. According to Palley, the only mechanisms that kept the economy from crashing were the overvaluation of assets, and firms filling the hole in aggregate demand by taking on more debt. However this excess of credit lead to financial instabilities that eventually crashed the economy in 2008.

In my opinion all these approaches are flawed. For one, the mainstream approach under-theorizes the sources of fragility and the secular decline in the rate of profit. It is true that much of the crises/business cycles have to do with the fragility of the capitalist economy to volatility, which is explained by mainstream models. However, an important part of the story is why the capitalist system is fragile to these shocks. In fact, mainstream economists showed their ignorance with their inability to forecast the effects of the 2008 recession. After the crash, mainstream economists implicitly conceded to the heterodox arguments of Minsky that the financial sector creates fragility. For example, only after the crisis did mainstream economists include in their DGSE models the financial instabilities mentioned by Minsky. Furthermore, it appears mainstream economics doesn’t really have a theoretical consensus on the secular decline of capitalism.

The problem with the Minskyan approach is that it is severely limited – for one, it only identifies one source of fragility, which is the financial sector. It also does not theorize why the financial sector is “less real” than for example, the manufacturing sector – which Minsky implicitly assumes when he blames fragility only to the financial part. Because of Minsky’s limited theorization, he also fails to explain the secular decline of the rate of profit, content with only explaining the business cycle.

The greatest flaw of the “orthodox” Marxist approach is its dependence on pseudo-aristotelian arguments. The TRPF model is based in a logical relation between very specific variables, which are the costs of raw materials and machinery (constant capital), the costs of human labor (variable capital), and the value extracted from the exploitation of human labor (surplus value). This spurious precision and logicality is unwarranted, as the capitalist system is too complex and stochastic be able to describe the behaviour of crisis as related to a couple of logical propositions. One has to take into account the existence of instabilities and shocks, as the mainstream economists do. However, Marx still had a key insight which is that the aggregate wealth of the world must be sourced in human labor that produces use values. The source of wealth comes from dentists doing dentistry, and construction workers doing construction work, not from the dentist trying to make money by trading in the stock market. Furthermore, Marx identified that there is a secular trend in the declining rate of profit, which is missing in other contemporary accounts.

Finally, Palley’s approach seems to be too politically motivated. To them, the stagnation of the economy is related to issues of policy – of statesmen adopting the “wrong” set of regulations/deregulations. If politicians were just “objective”, and followed Palley’s set of ideas, then crisis and decline could be averted! To Palley, the neoliberal phase was a matter of certain “top-down” policies rather than endogenous/spontaneous fragilities and instabilities that are inherent to the capitalist system. In my opinion, it’s impossible to disaggregate what is political and what is inherently structural in the secular decline of capitalism, since the whole world economy is more or less neoliberalized at this moment so there is no alternative to compare it at the present. So it seems to me that it’s a just-so story that is projected from the present to the past and impossible to prove empirically.

One of the issues I have with the “left” theories of crises, such as Keynesian and Marxism, is that they don’t take instability, uncertainty, stochasticity, and complexity seriously. Instead, proofs and discussions are reduced to aristotelian logical chopping related to a few variables. In the Keynesian case, it’s aggregate demand, in the Marxist case these variables are surplus value, constant capital, and variable capital. A system that pulsates with tens of billions of people is reduced to the logical chopping of a few variables. Instead, we must device a more holistic view of the capitalist world-system, taking into account its nonlinearities and fragilities.

The theories outlined above contain parts of the truth, so we can use some of these elements to synthesize a model of crisis that contains the following: (i) economic fragility to instabilities and shocks, (ii) endogenous sources of this fragility, (iii) a theory of the secular decline of the rate of profit. The concepts ultimately uniting these three points are fragility/nonlinearities and increasingly expensive complexity. For example, Minsky, by addressing the fragility in the financial sector, also implicitly points to a theory of degenerative complexity, where the financial sector acts as a complex, expensive, and fragile overhead that exists over the “real economy”.

We can use Taleb’s definition of fragility to make the concept more precise. Taleb mathematically defines fragility as harmful, exponential sensitivity to volatility. For example, a coffee cup can withstand stress up to a certain threshold, above that, the cup becomes exponentially vulnerable to harm, as any stress higher than that threshold will simply shatter the cup. The reason why fragility is a nonlinear property is that the cup won’t wear and tear proportionally to stress. Instead the cup will sustain the stress until a certain threshold is reached, and then suddenly shatter. So in other words, the cup reacts exponentially to stress, with stress below a certain threshold inflicting negligible damage.

Similarly, the capitalist world system probably has many thresholds, many of them currently unknown. This is because the capitalist world system is complex and nonlinear. It is complex because it is made of various interlocking parts (firms, individuals, governments, etc.) that form causal chains that connect across planetary scales. It is nonlinear because the behaviour of the system is not simply the “sum” of the interlocking parts, as the parts depend on each other. Therefore one cannot really study the individual components in isolation and then understand the whole system by adding these components. In other words, interdependence of the units within capitalism makes the system nonlinear. Furthermore, nonlinear systems are frequently very sensitive to change in its variables, where surpassing certain thresholds can make the system exhibit abrupt changes and discontinuities that often manifest as crisis. This abrupt changes caused by the crossing of certain threshold is a common mathematical property in nonlinear systems. Fragility therefore correlates with nonlinearities, abrupt jumps/shocks, and complexity.

However it is not enough to say that the capitalist world system is fragile because it is nonlinear. The point is that the capitalist world system structurally generates feedback loops that lead to the accelerated creation of endogenous fragilities. The frenetic pursuit of short-term profits in increasingly competitive contexts leads to the creation of fragile, nonlinear complexity. This is because a firm must invest in more expensive research, infrastructure, and qualified personnel to generate innovation that leads profit in the short term, as many of the “low hanging fruits” have already been plucked. So capitalism leads to a random “tinkering” by firms and institutions to produce profit, by often adding ad-hoc complexity. This complexity make generate short-term profits, but is expensive in the long term. Joseph Tainter tries to measure the productivity of innovation by looking at how many resources go into creating a patent. For example, here is a plot showing how ratio of patent per GDP and per R&D expenses has declined since the 70s:

Source: https://voxeu.org/article/what-optimal-leverage-bank

Source: https://voxeu.org/article/what-optimal-leverage-bank

Another marker of increased expensive complexity is how many people are required to create a patent:

Source: https://onlinelibrary.wiley.com/doi/full/10.1002/sres.1057

Source: https://onlinelibrary.wiley.com/doi/full/10.1002/sres.1057

A very common and studied example of this nonlinear complexity is the financial system. The financial system is an example of growth of complexity in order to aid the profit motive. Cash flows are generally too slow and cash reserves too low in order to cover the capital required to start firms, or to add a layer of complexity required for more profitability, so agents must resort to acquiring credit and loans. In other words the financial system acts as a fast, short-timescale distributive mechanism for the funnelling of resources to banks, firms and individuals that require quick access to capital in spite of low cash flows. Without the financial system growth would be much lower because access to capital could only be facilitated through cash flows. However, as Minsky noted decades ago and mainstream economics emphasizes now, the financial system is extremely unstable, complex and nonlinear, and therefore fragile. Here is a figure that shows for UK banks how much the “leverage ratio”, which is roughly the ratio between debt to equity of banks, has exponentially grown from the 1880s to the 2000s – in other words, banks depend on loans/credit in order to have fast access to capital.

Source: https://voxeu.org/article/what-optimal-leverage-bank

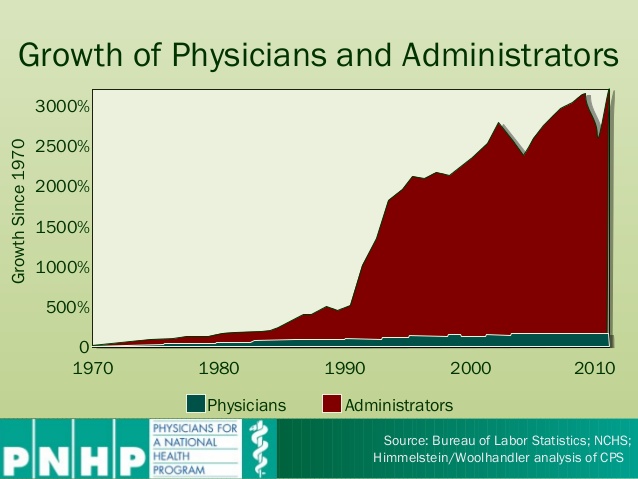

The addition of complex overhead as inversely proportional to growth has been empirically verified for various parts of capitalism. Here are some examples: the cost diseases associated with industries like education and healthcare, the admin bloat in education and healthcare, the stagnation of productivity across virtually all industries including manufacturing, the stagnation of scientific productivity in spite of exponential growth in the number of scientists and fields, etc.

Furthermore, capitalism encourages rent-seeking and expensive complexity, even if there are no benefits in wealth production for the economy in general. For example, this rent-seeking scenario is probably the case for admin bloat at the universities. In the case of this admin bloat, there is a transfer of wealth from society to certain sectors of the university, but there is no obvious economic benefit for society in general. This is in contrast to traditional, profitable industries were profit leads to capital valorization through the reinvestment of that profit.

As noted in a previous post, there is also a secular degeneration of science with the secular decline of capitalism. To summarize that post, as informational complexity grows at a faster rate than empirical validation and knowledge production, an informational bloat of unverified scientific theories gets created. An obvious example is the complex bloat of theoretical physics models that predict all sorts of new particles, in spite of the fact that the Large Hadron Collider, a multibillion dollar experiment, failed to confirm any of them. So you have a whole layer of professionals that are just experts in unverified/degenerative theories, and these professionals collect large salaries in spite of not contributing to economic nor epistemic growth. Another example of a degenerative profession is economics. Judging from the stagnating productivity across most industries, we can probably assume that these caste of degenerative professionals is rampant across all corners of capitalism. This caste of degenerative professionals and “degenerative” experiments add expensive and fragile complexity to capitalism.

Source: https://blogs.scientificamerican.com/cross-check/is-science-hitting-a-wall-part-1/

Source: https://blogs.scientificamerican.com/cross-check/is-science-hitting-a-wall-part-1/

Finally, as complexity grows, there is an increasing dislocation between abstracted logistical, degenerative, and “scientific” complexity and the human labor that creates the wealth. A very good example is finance. To paraphrase and elaborate on what Taleb said, the wealth of the world is created by dentists doing dentistry, and construction workers doing “construction work”, not by the dentist trying to become rich by trading their savings in the financial market. This is where Marx becomes relevant – for the wealth of society comes from human labor, not from the transfer of wealth through administrative and accounting tricks, or through the circulation of financial instruments. This bloated complexity is required for the functioning of capital because of financial, accounting, and logistical constraints. Much of this complexity acts as an overhead for the world-economy that is required for the survival of capital itself, but this complexity does not necessarily create socially necessary wealth. An example of the fragility of this separation between wealth creation and complex abstraction is the existence of speculative bubbles. Due to the overconfidence of the financial industry, assets are often overvalued and at some point their value collapses, as the dislocation between the real and financial economy becomes unsustainable. This financial instability was discovered by Minsky and that now is understood by mainstream economists, who incorporate it in their models.

Here we begin to sketch a theory for the secular decline of capitalism. First there is a secular increase of fragile, nonlinear complexity driven by ad-hoc tinkering of firms/institutions in order to pursue short term profits at the expense of fragility. Furthermore much of this expensive complexity is due to rent-seeking, where specialists trained in degenerative methods that add no obvious knowledge/efficiency self-reproduce and multiply, like string theorists, economists, university admins, healthcare admins etc. In the long run, all this added complexity that is created for short term profits becomes increasingly expensive, leading to even slower productivity growth (GDP growth per labor hour). Part of the lowering of productivity is the increasing dislocation between human labor that produces wealth and an abstracted layer of researchers, administrators, managers, etc. Furthermore not only there is a secular decline of the economy, but there are also increasing fragilities and instabilities, as the bloated complexity is very nonlinear, given that it couples agents across planetary scales, such as how the financial industry transcends national economies. So the world economy becomes increasingly more vulnerable to shocks, due to nonlinearities (caused by interdependencies) that lead to abrupt changes. These instabilities and fragilities give rise to the so called business cycle.

In conclusion, a socialist theory of crisis should begin by looking at the economy as a whole, taking into account its instabilities and fragilities. In my opinion, the methodologies of the various Keynesian and Marxist schools are wrong because they pretend to have identified a couple of important variables (e.g. aggregate demand, organic composition of capital) and then logically derive a theory of crisis through these variables. However, because the economic system is extremely complex and nonlinear, these theories probably amount to just-so stories, since the mechanisms behind the instabilities in capitalism are probably very varied (and many of them unknown), and therefore cannot be pinpointed to just specific sources. Instead, a better approach to a crisis theory is to analyze how capitalism creates endogenous feedback loops that lead to fragility, due to generalized and socially unnecessary nonlinearities and complexites. This nonlinearization and complexification is imposed in order to pursue short term profits, at the expense of long-term productivity. Moreover, another important issue is how a large part of this complexity becomes increasingly dislocated from wealth creating labor – such as the dislocation between administrators and professors, or the financial sector and the real economy.

I am confident many of the theories presented in this article can be both quantified and verified against empirical data in a much more rigorous way than done here. But alas, there isn’t an eccentric millionaire backing this research program😞.

If you liked this post so much that you want to buy me a drink, you can pitch in some bucks to my Patreon.

” . . . the wealth of society comes . . . not from the transfer of wealth through administrative and accounting tricks, or through the circulation of financial instruments.”

Although this proposition seems to support an anti-capitalist affinity – i.e. ‘professionals collect large salaries in spite of not contributing . . .’ – I think it can be said, in fact, to be a proposition supporting laissez-faire capitalism.

This ‘excess’ overhead, in degree, comes from legal requirements – such as environmental regulations, workplace health and safety regulations, Security and Exchange Commission compliance, etc. Thus, although the legal requirements have societal benefit, a productive cost is incurred.

‘Government regulation’ becomes the bad guy, the problem; Capitalists can be portrayed as the stooge to government overreguulation. Resultantly, proposals of deregulation are valid. Deregulation, i.e. laissez-faire capitalisism, becomes the cost-wise solution. Of course, under such a scenario pollution increases, workplace health declines, and securities frauds are committed.

LikeLike

Hi. Your argument would only be valid if all the complexity bloat is related to safety/ecological regulations issued by the government etc. which is simply not true. Some of it is “scientific/managerial/engineering” complexity, and some of it has to do with the legal constraints that are related to the form of private property (e.g. corporate lawyers). When I mentioned financial complexity I didn’t mean “fraud regulation” but the whole industry of finance, which I believe is socially unnecessary and only exists because capitalism need it.

In fact, recently Graeber, an anarchist/leftist anthropologist released a book on this same topic of complex overhead, which he calls “Bullshit Jobs”.

LikeLike

You make some good points need to re-read the article to wrap my head around some of the ideas. You do get the mind thinking 🙂

LikeLike

What value does insurance companies add to healthcare and are Insurance companies necessary for the healthcare industry?????

LikeLike

This is just an advertisement that I placed a comment on the post from November of 2017 titled someting along the lines of Free Speech for the benifit of Humanity. I place this ad here because I know that most people who not go so far back in the history of the this site to read the comments after the articles.

LikeLike

Hello,

I enjoyed this post very much. I was just introduced to your work via the swamp side chats podcast. I assume you’re familiar with Steve Keen’s work? I’d be curious of your thoughts. Take care.

LikeLiked by 1 person

“So you have a whole layer of professionals that are just experts in unverified/degenerative theories, and these professionals collect large salaries in spite of not contributing to economic nor epistemic growth.”

I was not aware that my basically minimum wage salary (on short-term contract) is large. Thanks for the info!

LikeLike

In another post, you defend the necessity of cranks. I’m curious as to what the position of “crank” research programs is in this complexity argument, at least in scientific research. It seems like they certainly add lots of complexity without much emperical verifiability. Is your argument more along the lines that cranks provide new theoretical frameworks from data instead of ad-hoc complexifying older theories to explain phenomena?

LikeLike